"Your Local Tax Problem Solvers Since 1992"

ORLANDO: 407-915-3470

TAMPA: 813-708-5530

A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt.

A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt.

The IRS tax lien protects the government’s interest in all of your property, including real estate, personal property and financial assets.

A federal tax lien will arise only after the following three events occur:

Generally, a bank must freeze your account for 21 days from the date of the Bank Levy before it is required to turn over the funds to the IRS. This gives the taxpayer, the bank and the IRS an opportunity to resolve the matter before the taxpayer’s funds are lost.

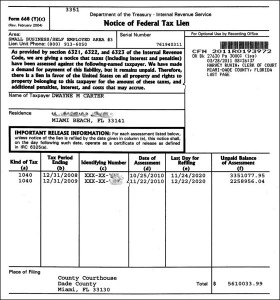

The IRS files a public document, the Notice of Federal Tax Lien, to alert creditors that the government has a legal right to your property.

Paying your tax debt in full is the surest and fastest way to get rid of a federal tax lien.

The IRS releases your tax lien within 30 days after you have paid your tax debt.

Options: When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a federal tax lien exist.

An IRS tax lien attaches to all of your assets (such as property, securities and vehicles) and to future assets acquired during the duration of the tax lien.

An IRS tax lien attaches to all of your assets (such as property, securities and vehicles) and to future assets acquired during the duration of the tax lien.

Once the IRS files a Notice of Federal Tax Lien, the presence of the tax lien may limit your ability to get credit.

The federal tax lien attaches to all business property and to all rights to business property, including accounts receivable.

If you file for bankruptcy, your tax debt, lien, and Notice of Federal Tax Lien may continue after the bankruptcy.

The tax attorneys, CPAs, and IRS enrolled agents at The Pappas Group in Orlando have more than 50 years of experience helping taxpayers avoid IRS tax liens or getting IRS tax liens released.

Call us today for a free consultation about your case.

Avoiding an IRS tax lien

You can avoid a federal tax lien by simply filing and paying all your taxes in full and on time.

If you can’t file or pay on time, don’t ignore the IRS notices and IRS letters you receive.

If you can’t pay the full amount you owe, you may enter into an IRS installment payment plan or obtain an IRS settlement (an Offer in Compromise) of your tax debt.

A federal tax lien is not the same as an IRS levy. A tax lien secures the government’s interest in your property when you don’t pay your tax debt. A tax levy is the actual IRS seizure of property to pay the tax debt.

If you don’t pay or enter into an IRS tax installment payment plan or IRS tax settlement (an Offer in Compromise), the IRS can and will levy, seize and sell any type of real or personal property that you own or have an interest in.

The IRS audited my 2007 and 2008 tax returns and disallowed 100% of my business expenses because the auditor said I didn’t have sufficient records. I hired The Pappas Group and they were able to prove by other means that my deductions were valid and the IRS ended up only disallowing about 15% of my expenses. Had I not hired Pappas I would been assessed taxes, penalties and interest in excess of $100,000. The Pappas group now does all of my accounting work and prepares both my business and personal tax returns.

Sign up now to receive tax updates and special offers.

Toll Free: 866.529.9040

Orlando: 407.915.3470

Tampa: 813.708.5530

The Pappas Group

Baldwin Park

4798 New Broad Street

Suite #210

Orlando, FL 32814

The Pappas Group

Rocky Point Center

3030 N. Rocky Point Dr.

Suite #150

Tampa, FL 33607